Foundation Blog

Read all about our impact in the community, upcoming events, news, and general information about our Community Foundation.What’s Happening

News & Notes

Help Beautify Downtown Menomonie with Flower Baskets

🌸 Help Keep Downtown Menomonie Blooming! 🌸 Every spring, the GFWC – Women’s Club of Menomonie partners with our Foundation to bring vibrant flower baskets to downtown light poles. These cheerful blooms aren’t just pretty—they help make our city feel...

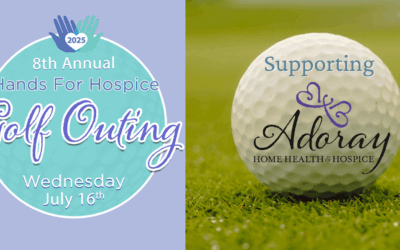

Register for the 8th Annual Hands for Hospice Golf Outing

We are pleased to announce our 8th Annual Hands for Hospice Golf Outing on Wednesday, July 16, 2025. Through your generosity, we can continue meeting our mission of keeping Hospice alive in our community to support life and death with dignity.

Celebrate Nonprofits at our Annual Luncheon

Registration for this event is now closed. If you've registered to attend, we look forward to seeing you on May 15th! If you have not yet registered but are still interested in attending, please call our office at 715-232-8019 to see if there are still spots!We look...

Stay up to date

Nonprofit Organizations

Planned giving and big gifts go hand in hand

The news about large gifts keeps coming! And “big bet” philanthropy in general has been in the news recently, reportedly because donors’ approach to giving at scale is changing thanks to a greater focus on relying on the experts in organizations to deploy resources...

Donor-advised funds: Your new best friend?

A donor-advised fund is one of many types of funds that an individual, family, or business can establish with the Community Foundation of Dunn County. You’re likely more aware of donor-advised funds than other types of funds because they are frequently covered in...

Unrestricted gifts: Helping your donors break through myths

The team at the Community Foundation of Dunn County frequently hears from nonprofit professionals about how difficult it is to communicate to donors the value and importance of unrestricted gifts. This is especially the case when you and your colleagues are striving...

charitable giving partnership

Professional Advisors

Planning for a sunset: Lock in a higher exemption, unlock a legacy

Without legislation to prevent it, the sunsetting of current estate tax laws at the end of 2025 will dramatically reduce the federal estate tax exemption from $13.61 million per person in 2024 to approximately $7 million in 2026 (this includes adjustments for...

Mixing business and charity: Keep it ethical, legal, and transparent

Your clients who are corporate executives have likely wondered at some point about the benefits of aligning their companies with philanthropy, whether specific causes or particular organizations. In general, a community engagement strategy can be good for business, if...

Gifts of appreciated stock: Picking favorites

You’re well aware that donating highly-appreciated stock to a fund at the Community Foundation of Dunn County offers significant advantages for your clients over making cash gifts. Communicating this benefit, however, can be challenging when clients have emotional...