Foundation Blog

Read all about our impact in the community, upcoming events, news, and general information about our Community Foundation.What’s Happening

News & Notes

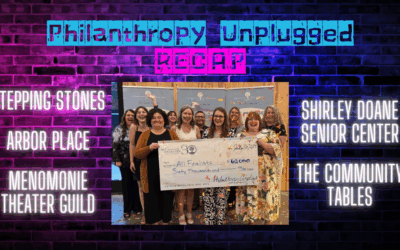

$60,000 Awarded at First-Ever Philanthropy Unplugged

Community, craft beer, and collective giving took center stage last Wednesday at Lucette Brewing Company, where more than 100 local residents gathered for the first-ever Philanthropy Unplugged, an unforgettable night of live voting, local impact, and unexpected...

Goal Achieved! 15 Nonprofits Approved for $5k Match

We’re excited to announce that we have officially completed our goal of approving 15 nonprofit endowment funds through our $5k Match Initiative! Each organization will receive up to $5,000 in matching dollars as they build a permanent source of long-term support for...

We Are Hiring a Philanthropy Officer! Apply Now.

The Philanthropy Officer is responsible for building meaningful relationships with current and prospective donors to grow the Foundation’s philanthropic resources. This half-time position focuses on securing major gifts ($10,000 or more) and guiding individuals,...

Stay up to date

Nonprofit Organizations

Show Me The Money: When does your endowment fund actually receive a bequest?

For decades, bequests have been a small but relatively steady component of total charitable giving in the United States. You certainly understand the importance of bequests to growing your endowment fund at the Community Foundation of Dunn County. To that end, your...

Cryptocurrency: “Yes” to gifts, “No” to endowment building

Growing your endowment fund at the Community Foundation of Dunn County is no doubt a top priority. Through your endowment fund, your donors have a meaningful opportunity to ensure that your mission stays strong for generations to come. As always, the team at the...

$52,000 Awarded to Area Nonprofits

The Board of Directors of the Community Foundation of Dunn County (CFDC) recently awarded over $52,000 in grants through our August Competitive Grant Cycle. Each year, the Foundation invites area non-profit organizations and community groups to apply for grant funding...

charitable giving partnership

Professional Advisors

Gifts of real estate: Watch every step

We’re hearing from more and more attorneys, accountants, and financial advisors that your clients are expressing interest in giving real estate to charity. This is wonderful news! You’re certainly aware that gifts of real estate to a fund at the Community Foundation...

Less can be more: Charitable giving helps parents pass wealth to children

How much is too much? That’s a question many parents ask as they structure lifetime gifts and bequests to children in their financial and estate plans. Wealthy clients are sometimes concerned that leaving millions of dollars, or even hundreds of thousands, to their...

Counting pennies: How to counsel frugal yet charitable clients

Over the years, you’ve no doubt experienced a wide range of what clients perceive as “wealthy.” You’ve likely also observed that clients have different assumptions about what it takes to be a “philanthropist.” The interplay between a client’s perception of personal...